Most signs point to resilient Australian share market returns over the long term

The Australian share market has been more volatile than normal lately due to a number of factors.

These include questions about the strength of the global economy due to a deceleration of growth in China, the prospect of rate rises in the US, and ongoing struggles managing debt loads in Europe and Japan.

While the likelihood of a short term recession in Australia has risen a little recently, we believe there are a number of drivers of economic growth for the Australian economy which should be beneficial for the Australian share market over the longer term.

A resilient Australian economy

In comparison to its resource exporting peers of Canada and Brazil, Australia remains the lucky country as it is not currently experiencing a recession.

After having benefited immensely from the resources boom resulting from China’s seemingly unquenchable demand for resources as it embarked on its massive infrastructure and construction boom, the Australian economy has subsequently experienced a construction boom of its own on the back of historically cheap capital and an undersupply of accommodation.

The housing construction boom has helped to shield Australia from the slowdown in the resources and mining services sectors.

Despite downgrades to global growth forecasts, the Australian economy is resilient and is still growing at over 2%. While the risk of recession has risen recently, we do not consider it as the most likely outcome for a variety of reasons:

The success of the Australian economy has previously been much more dependent on the resources sector.

In 2008, the ASX200 was comprised of approximately 35% resource companies. Today, the ASX200 has a resource company index weight of 15%, so it is a lesser driver of overall returns.

Global growth concerns have centred on lower levels of growth emanating from China’s infrastructure-led economy. Australia’s lower weighting to resources companies means that the Australian economy (and share market) is now less reliant on commodity exports to China.

As opposed to the resource sector weighting, the financial sector has grown to become a large proportion of the ASX200, and it is looking reasonably solid in the long term.

Sure, a catalyst for a recession could be a large slowdown in the banking sector which could be caused by large falls in residential property prices. But the boom in Australian major city residential property prices continues albeit at what appears to be a more subdued pace.

So we do not see this as a portent for a crash in the residential property market.

Here’s why:

- We do not have a major oversupply of housing. Though recent apartment construction has addressed some of the shortage.

- Interest rates remain at historical lows with very little prospect they will rise materially any time soon, particularly given the outlook for growth. That said, valuations are lofty and the market could experience a correction but a collapse is most unlikely.

- As the demand for commodities has fallen, so has the value of the Australian dollar. This currency depreciation has created a number of opportunities for outward facing Australian companies, especially those exposed to the Chinese consumer.

The next growth phase – taking advantage of China’s growing household wealth

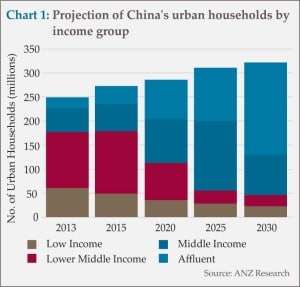

Evidence continues to grow of China’s transition to a consumer-led economy. Chart 1 illustrates the significant changing composition of the Chinese population as they transition to a higher standard of living.

This process represents the noteworthy opportunity that Australia has to engage with China on many facets which are expected to provide substantial growth opportunities for Australian companies in the future.

An increase in Chinese incomes will ultimately result in higher household wealth. This is likely to allow for increases in expenditure on higher order consumables including discretionary lifestyle expenditure which could include leisure, travel and entertainment.

Australia’s property market has already witnessed a marked increase in capital inflow from Chinese buyers. Going forward it is expected that other Australian sectors such as tourism, education and agriculture will be positively impacted by the improvement in China’s standard of living.

Chinese tourism to double in Australia

Currently only around 3% of the Chinese population have an international passport. This compares to around 50% of Australians and 33% of Americans. Over the next five years it is expected that the percentage of Chinese holding an international passport will double to 6%. To put this into context, this amounts to an additional 40 million international passport holders.

The current amount of money the Chinese spend on leisure activities such as travel and entertainment currently accounts for only 9% of overall spending in China compared with 16% in Japan and 17% in the US.

As this figure moves upward, Australia is likely to benefit.

The Chinese consider Australia as a friendly welcoming tourist destination that is relatively close, clean, and above all else, extremely safe.

According to Tourism Australia there were 939,500 visitors from China in the financial year ended June 2015, an increase of 21.6% on the previous year. These visitors generated about $6 billion in expenditure and it is estimated that Chinese visitor expenditure here will grow to $13 billion by 2020.

This presents substantial opportunities for the tourism and hospitality sectors of the Australian economy.

Australian agriculture to benefit from Chinese demand for higher quality food

The rise in personal incomes experienced across Asia has seen a higher demand for quality agricultural produce.

Recent negotiations for a free-trade agreement point to the potential for a dramatic transformation in the agriculture sector in Australia. Substantial investment is expected to flow into the sector as Chinese corporations seek to establish supply chains from high quality farms in Australia to Chinese supermarkets.

This again is a large opportunity for higher Australian economic growth.

The two growth opportunities described above (i.e. tourism and agriculture) typify those that are expected to play out over the longer term and are supportive of our positive outlook for the Australian economy and financial markets generally over the next 10+ years.

Market Positioning and Outlook

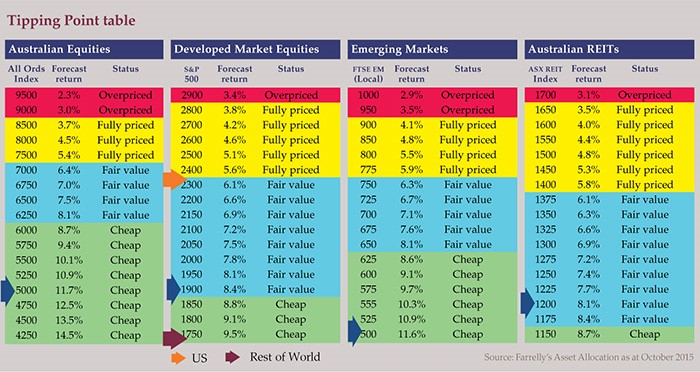

As evident in our tipping points table (below), we see most share market and property market price indices as being in the ‘cheap’ to ‘fair value’ range for the long term.

After recent falls, even the US share market has moved into the ‘fair value’ range.

Our outlook for investment markets, therefore, remains generally positive with global economic growth continuing to recover albeit at a benign pace.

As China’s economy transitions to become consumer-led, there are expected to be challenges, but we believe the transition will present a number of opportunities that provide support for sustainable long term growth in the global economy.

We expect Australia to be a key beneficiary of this process.

If you have any queries regarding this, please contact us at HTA Wealth to arrange a time to meet with Scott Millson.

This document is not advice and provides information only. It does not take into account your individual objectives, financial situation or needs. HTA Wealth Services are provided by Scott Millson, Authorised Representative of Australian Unity Personal Financial Services Ltd AFSL: 234459