Recently Xero made some changes to the tax rate component of Xero Chart of Accounts. It now defaults the Wages and Super expense accounts with a tax rate of GST exempt.

Recently Xero made some changes to the tax rate component of Xero Chart of Accounts. It now defaults the Wages and Super expense accounts with a tax rate of GST exempt.

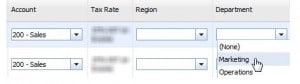

Please be mindful that if these accounts were still attached to the GST Exempt tax rate, they would have been mapped to the BAS Excluded tax rate after the tax rate changes. Any account types that were linked to the No GST tax rate would have been mapped to the new tax rate BAS Excluded with the exception of Expense accounts in which case will be mapped to GST Free expenses. Therefore, where an Expense account originally had the No GST tax rate, this will now become GST Free expenses.

Any other accounts that are not defined as an expense account, will be mapped to the BAS Excluded tax rate. If you wish to change the tax rates from GST Free Expenses to BAS excluded, you can do so by editing the Bill. All Bills in Xero can be edited, except Bills that have had payments applied against them. Any Bills that have had a payment applied will need to have this payment temporarily deleted before they can be edited.

Please see the link below to the Xero Help Centre for more details. Xero Help Centre: Edit paid bill You can also contact your HTA Advisory representative for guided support.