Bank rules are a quicker and easier way to reconcile your bank statements in Xero. If you deal with cash transactions or have transactions that don’t have an invoice to match to (eg. Interest, bank charges, direct debits, etc) then bank rules are perfect for you.

With bank rules you define the conditions for each rule to match with your bank statement lines. After your bank statement is imported, either manually or via live bank feeds, and you go to reconcile your account, your rules run.

For each bank transaction that matches a rule, Xero automatically creates a transaction using the details of the conditions you’ve set. If the transaction that Xero creates based on the rule is wrong, you can edit it, create a new one or find a transaction you’ve already entered into Xero to match with your statement line. If it is correct, in most cases, you just need to click OK.

Bank rules are for the automatic creation of cash transactions in Xero, so they differ to how Xero matches transactions (eg. invoices & statement lines) and makes suggestions for matching transactions when you reconcile.

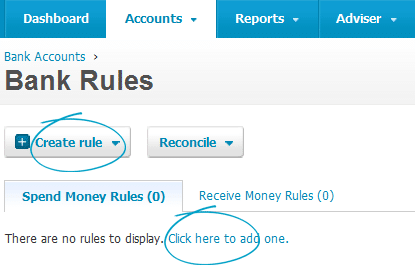

Go to Accounts > Bank Accounts and select the Bank Rules button to get to the Bank Rules screen, or use the Bank Reconciliation screen. You’ll need to have at least 1 bank account set up to use bank rules. Your user role will also determine if you have full access to add bank rules.

There are many ways to create, edit and manipulate your bank rules, Xero’s help section will assist you further, otherwise contact your Xero Expert at HTA Advisory to assist.